Great news for PM job seekers: October 2025 PM Job Report

This week I shared my latest PM Jobs Report on LinkedIn and Reddit—and the news was the best I have been able to share all year.

If you find this helpful, forward it along—or subscribe here if this was forwarded to you.

The big takeaways

With 24,067 open listings, the global PM job market posted its strongest month-over-month growth in recent memory at 7.1%. This marks a significant acceleration from September's 2.9% growth and signals robust momentum heading into Q4.

Global growth accelerated sharply after September's modest gains, with all major markets contributing to expansion.

LATAM led the charge with an extraordinary 52% surge, followed by the Middle East (+12%) and EEA (+7%).

Remote work rebounded strongly (+15%), now up 26% over six months and 19% year-over-year.

Entry and mid-level roles surged with Associate PM and PM positions both jumping 8%, while Senior PM roles grew 3.3%.

Leadership roles pulled back (–3.7%) this month but remain up 11% over six months, indicating sustained executive hiring appetite.

The US market stalled at –0.2% while Canada declined 6.2%, but both regions remain above their starting points for 2025.

For job seekers, the theme this month is strong momentum with regional opportunity—expanding markets and robust demand across seniority levels make this one of the most promising months of the year.

Regional breakdown

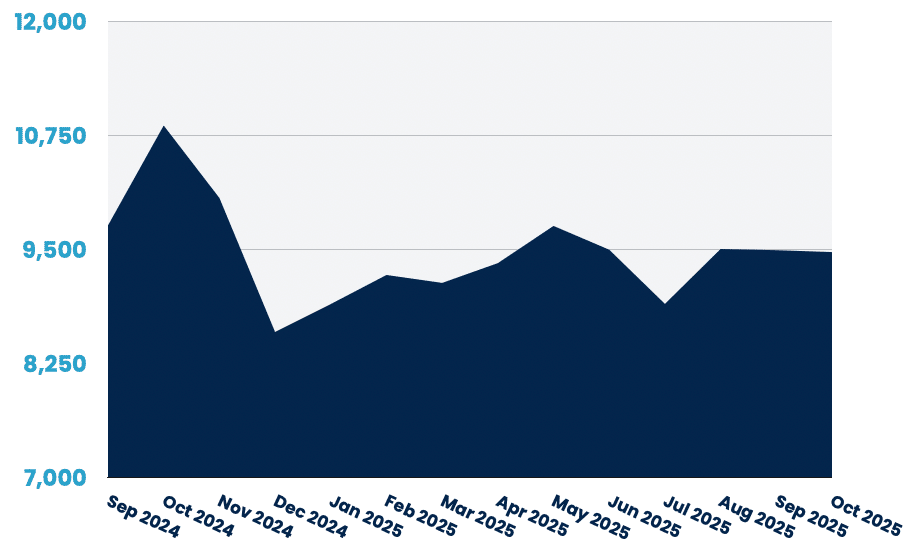

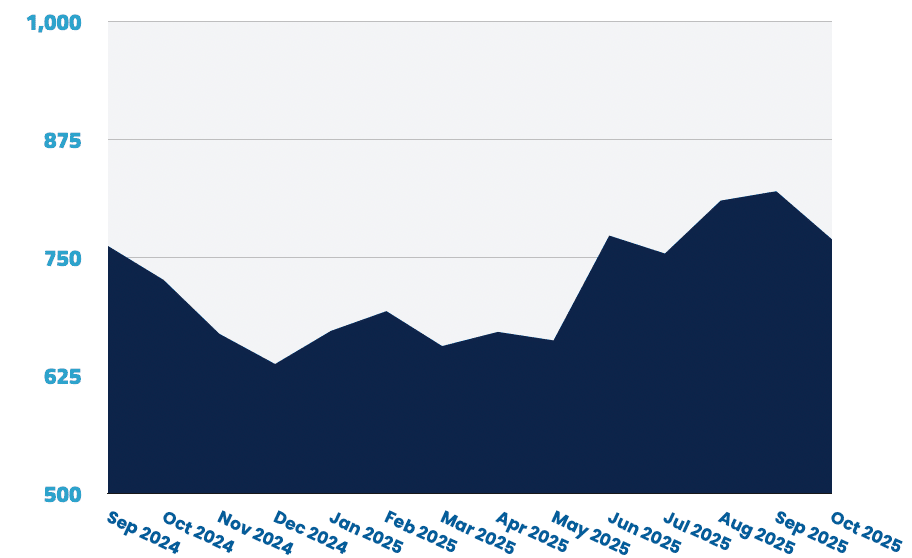

United States: Nearly flat after recent growth

The US market held steady with 9,468 PM jobs, essentially flat (–0.2%) after September's 2.9% growth. Mid-level roles grew 2.6%, but senior positions fell 5.4% and leadership stayed nearly flat (+0.4%).

Remote roles ticked up modestly (+1.6%), while hybrid jumped 5.1% and on-site fell 1.7%. The US market remains stable but competitive, with growth concentrated in specific role types and work models.

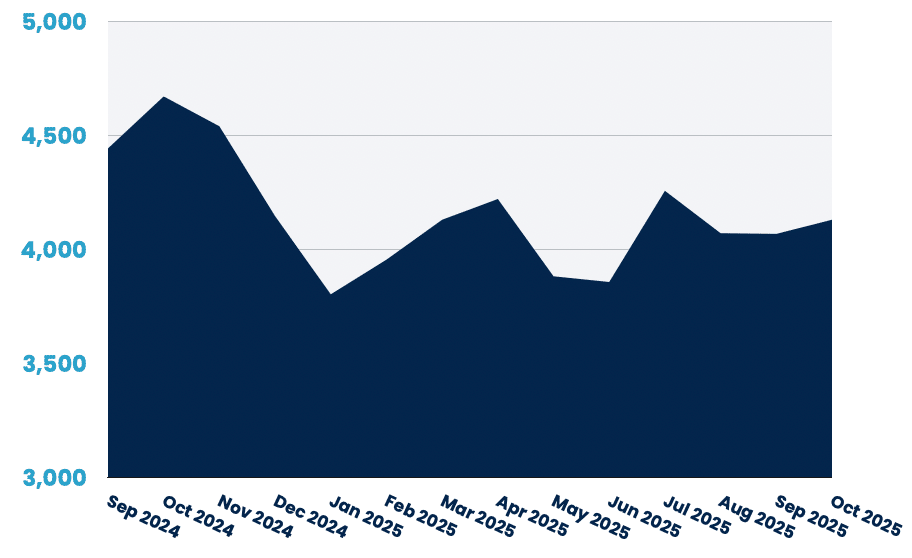

APAC: Modest uptick after flat September

APAC reached 4,129 jobs (+1.5%), a welcome reversal after September's flat performance. Associate roles surged 18%, but senior positions fell 4.7% and leadership dropped sharply (–13%).

Hybrid work jumped 7% while remote fell slightly (–1.3%). The market remains 12% below last year, suggesting ongoing recovery challenges.

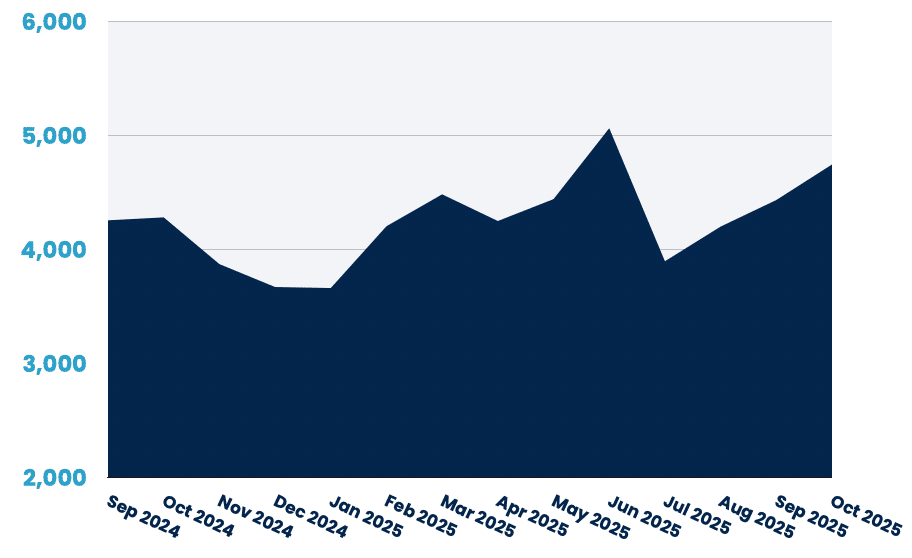

EEA: Strong consecutive growth

The EEA posted 4,743 jobs (+7%), marking its second consecutive strong month after rebounding from July's sharp decline. Senior roles led the way at +13%, with PM roles up 5.6% and leadership up 15%.

Remote opportunities continued their surge (+15%), now up 28% over two months and an extraordinary 166% year-over-year.

The EEA is rapidly expanding remote-first opportunities for product managers.

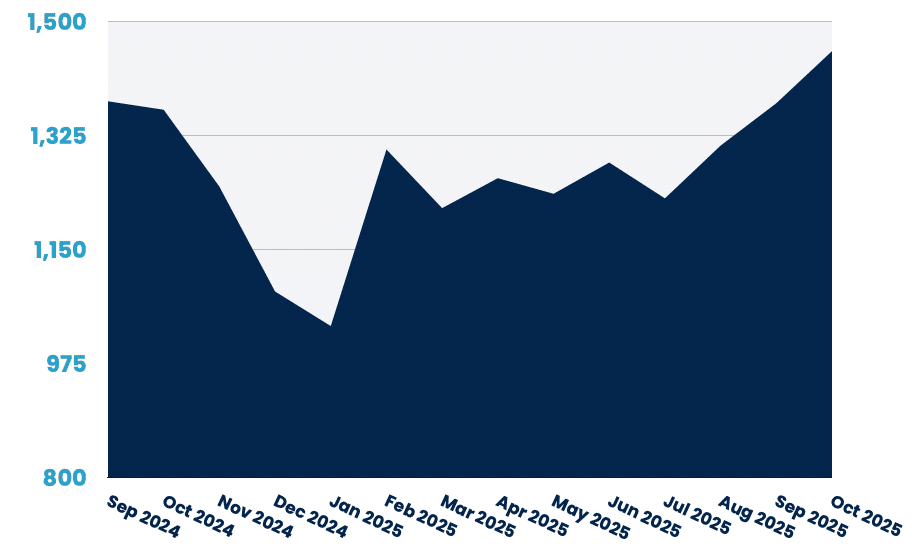

United Kingdom: Steady climb continues

The UK grew to 1,454 jobs (+5.8%), extending its consistent upward trajectory. Senior roles posted strong gains (+6.6%), with PM roles up 5.7% and Associate roles flat.

Remote work jumped 11%, continuing its 33% surge from September. On-site roles spiked 17%, indicating UK firms are expanding across all work models simultaneously.

Canada: Pullback after recent gains

Canada fell to 769 jobs (–6.2%) after September's modest growth. Associate roles surged 50% while senior positions declined sharply (–23%), creating divergent opportunities by seniority.

Hybrid roles jumped 16% while remote fell 21%, suggesting a shift back toward office-based arrangements. Despite the monthly decline, Canada remains up 15% over six months.

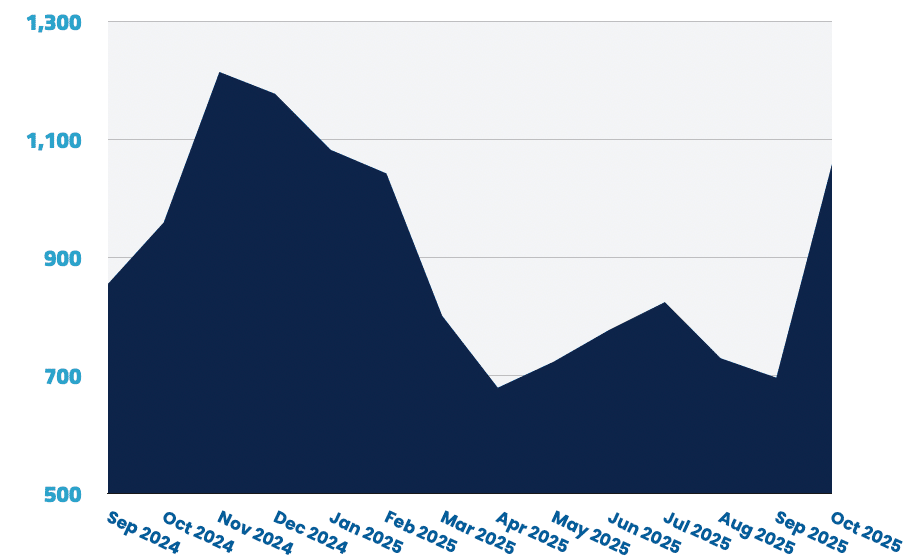

LATAM: Extraordinary monthly surge

LATAM exploded to 1,058 jobs (+52%), the strongest regional performance of the month. PM roles grew 42% and senior roles surged an astonishing 140%, while leadership positions fell 61% from an unusually high base.

Remote opportunities more than doubled (+122%), reversing September's 14% decline. The volatility in this market creates significant opportunities for those monitoring it closely.

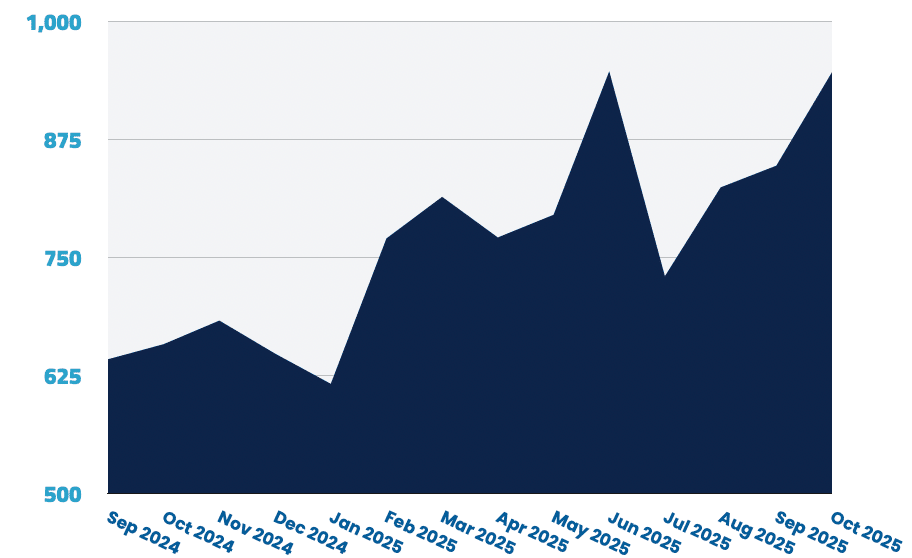

Middle East: Sustained strong growth

The Middle East reached 946 jobs (+12%), continuing its position as the fastest-growing region year-over-year (+44%). Associate roles grew 14% and PM roles grew 12%.

Remote positions jumped 12%, now up 52% over two months and 180% year-over-year. The Middle East continues to lead in remote work expansion globally.

Seniority trends

Associate roles: Strong rebound across most markets

Associate PM roles jumped 8% globally this month. Growth was strongest in Canada (+50%), APAC (+18%), Middle East (+14%), and LATAM (+35%). The US posted only 0.5% growth while the UK stayed flat.

The two-month trend remains down 7.7%, but the six-month view shows 10% growth, suggesting renewed investment in early-career talent.

Mid-level PMs: Broad-based growth

Mid-level roles grew 8% month-over-month, with strong gains across most regions. The US (+1.1%), EEA (+5.6%), and UK (+5.7%) all contributed to expansion.

Over six months, PM roles are up only 2.5%, indicating this level continues to see the most competition relative to available openings.

Senior PMs: Modest growth with regional divergence

Senior roles grew 3.3% globally, but regional patterns varied widely. The EEA (+13%) and UK (+6.6%) posted strong gains, while the US (–5.4%), APAC (–4.7%), and Canada (–23%) declined.

The six-month trend shows 14% growth, making this one of the strongest-performing seniority levels over the medium term.

Product leaders: Monthly pullback masks longer-term strength

Leadership roles fell 3.7% this month after September's gains, with significant declines in APAC (–13%), UK (–13%), and especially LATAM (–61% from an unusually high base).

Despite the monthly decline, leadership positions remain up 11% over six months and 7.6% year-over-year, indicating sustained demand for product executives.

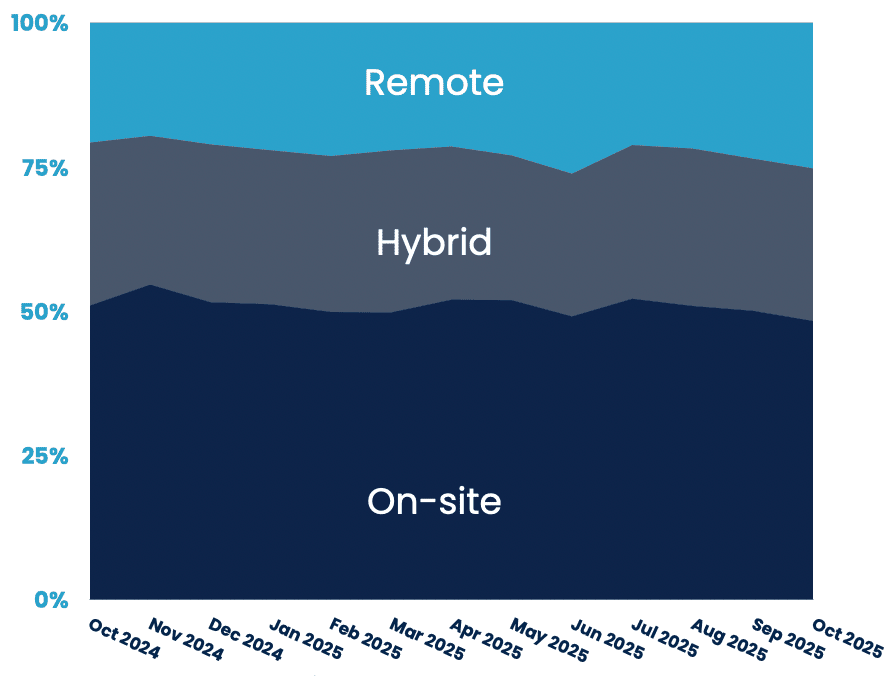

Work environment

On-site: Modest growth continues

On-site positions grew 3.4% month-over-month and account for the majority of PM roles globally. Growth was strongest in the UK (+17%), Middle East (+21%), and LATAM (+33%).

Over six months, on-site roles remain nearly flat (–0.8%) and are down 7% year-over-year, suggesting a gradual shift toward flexible arrangements.

Hybrid: Steady expansion

Hybrid roles grew 7.4% this month, with strong gains in the US (+5.1%), EEA (+11%), and Canada (+16%). This work model continues to gain traction as companies balance collaboration with flexibility.

The six-month trend shows 6.3% growth, making hybrid one of the most stable and expanding work models.

Remote: Strong comeback continues

Remote opportunities surged 15% month-over-month, the strongest performance of any work model. Growth was led by LATAM (+122%), EEA (+15%), and the Middle East (+12%).

Over six months, remote roles are up 26%, and year-over-year they're up 19%—a remarkable recovery after earlier volatility. Remote work is clearly rebounding in key markets worldwide.

That's it for this month's report.

If you're looking for guidance on how to navigate today's job market, you can join my upcoming Resume Workshop.

Wishing you success on the journey ahead.

James